Cost involved with selling your property in Malaysia

It may come as a surprise to some homeowners that selling a property incurs costs such as taxes, professional fees, and repairs. This expenditure often means sellers take home a sum lower than the selling price after factoring in the necessary deduction.

Here are the costs associated with selling a property in Malaysia.

1. Legal fees

The buyer is required to enlist a lawyer to draft a Sales and Purchase Agreement (SPA), prepare a letter of offer, as well as other legal documents and legal processes to complete the transfer.

The seller, however, is not legally required to appoint a lawyer for themselves. Still, one acting on the seller’s behalf is highly recommended to safeguard his or her interest.

The seller’s lawyer may argue for terms to be added in the SPA in their favour, assist in disputes, prevent fraud or delay, and ensure proceeds of the sale are received by the seller.

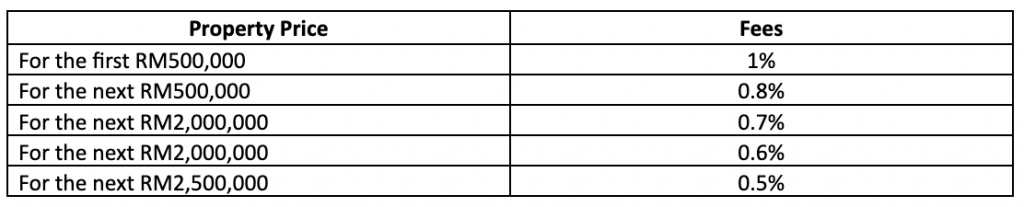

For the seller, the fees for appointing a lawyer are minimal and far outweigh the risks of being unrepresented. Legal fees are based on the property’s selling price as follows:

2. Property agent fees

Property agents have more advertising avenues and are better able to advise on asking prices, filter prospects, and act as an intermediary to safeguard the interests of both buyer and seller.

Prospective buyers might also find it safer and easier to purchase a home via property agents, as they would be able to advise on loan eligibility, financing options, and the necessary processes.

Note, however, that owners may choose to sell a property themselves and save on agents’ professional fees, which are capped at a maximum of 3% of the selling price.

In practice, property agents typically charge 2-3% of the selling price, while a sales and services tax is also required by the government on the sum paid to the agency for services rendered.

Here is an example of the costs of hiring a property agent:

- Property selling price: RM500,000

- Agent fees: 3% x RM500,000 = RM15,000

- 6% SST x RM15,000 = RM900

- Total payable: RM15,000 + RM900 = RM15,900

These fees are deducted from the down payment or earnest deposit paid by the buyer, so sellers do not have to fork out the sum beforehand.

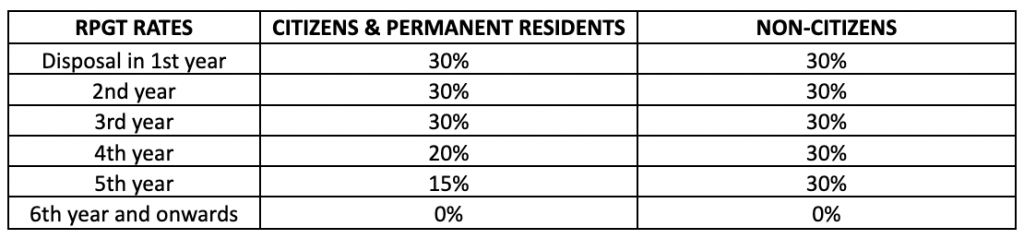

3. Real Property Gains Tax (RPGT)

RPGT is a form of capital gains tax intended to curb property speculation. As such, owners looking to sell off their property in Malaysia must pay a percentage of the profits of the sale to the government.

Those who do not profit from the sale are not required to pay RPGT – for instance, when the selling price is lower or equal to the property’s original purchase price.

As of this year, RPGT exemption is provided on the sale of a property from the sixth year onwards.

4. Maintenance or repair costs

While properties can be sold on an “as-is” basis, it is often wiser to make minor repairs to fetch a better value. Spending a small sum to add a fresh coat of paint, patch up cracks, or replace broken tiles goes a long way in securing potential buyers in a competitive market. It also gives a good first impression to potential buyers and leaves less room for haggling on the price, which could be disadvantageous to the seller.